Income tax – is a government levy imposed on the income of an individual. We can calculate income tax. It is not a complex task, if you are aware of the income tax slabs of that particular year and know the mathematical calculation

Income Tax Slabs

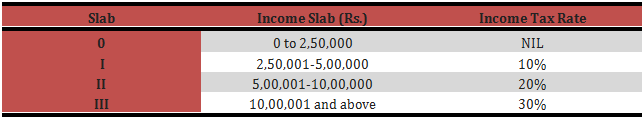

First of all to be aware of the taxation slabs released each financial year by the Indian Government. The taxation slabs for the 2014-15 for General tax payers and Women-

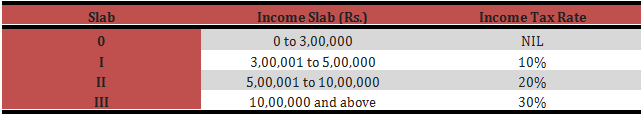

Tax slabs for senior citizens (Aged 60 years but less than 80 years)-(2014-2015)

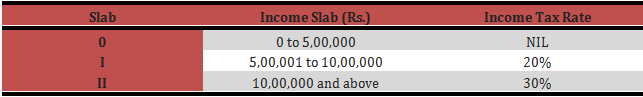

Very senior citizens (Aged 80 and above)-(2014-2015) Deductions available for saving tax

Deductions available for saving tax

To opt for saving the maximum amount of tax, examine the deductions defined under different sections of the Income Tax Act, 1961.

The available deductions are:–

- Investment under Section 80

This section includes: –

- Mediclaim insurance premium (u/s 80D)

- Donations with 100% benefit (u/s 80G)

- Interest repayment for education loans (u/s 80E)

- New Pension Scheme for a maximum of 10% of the basic salary (u/s 80CCD)

- And Rajiv Gandhi Equity Savings Scheme (u/s 80CCG).

The Investment limit for the deduction under Section 80C of the Income-Tax Act, 1961 was raised from Rs 1 lakh to Rs 1.5 lakh as per the budget 20014-15. This will result in a maximum saving of Rs. 15,450 to investors in the 30% tax bracket. The most common investments fall under this section: –

- Life Insurance policies

- Employees Provident Fund/Public Provident Fund

- National Savings Certificates or Interest accrued on old NSCs

- ULIPs (Unit Linked Insurance Plans)

- Repayment of home loan for principal amount only.

- Pension Funds u/s 80CCC

- Tax saver Mutual Funds – ELSS: Equity Linked Savings Scheme

- Tuition fees of children’s education.

- Housing Rent Allowance u/s 10(13A).This is an allowance you get as a company employee for paying house rent. Deduction available on House Rent Allowance is an amount which is the least of the following parameters:–

Actual HRA received

OR

Actual rent paid by you minus 10% of your basic salary and other allowances (excluding HRA)

OR

50% of your basic salary

In cases where the last two parameters determine the deduction amount, and turns out to be less than the HRA paid by your company, the excess amount is considered as a part of your taxable income.

- Home Loan Benefit u/s 24. This gives you deduction for the interest that you pay on your home loan and the maximum deduction limit has been raised (as per 2014-2015) to Rs. Rs.2,00,000 for a self-occupied property. For a property that is not self-occupied, there is no upper cap on the deduction limit.

Calculating your Taxable Income and Income Tax

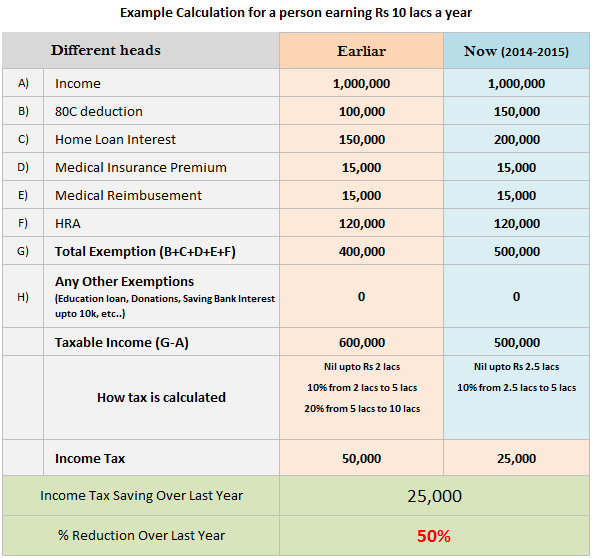

In order to do the calculation, it is imperative to understand how income tax is deducted. If your income falls within a certain slab only, say Slab I (as per the tax slabs mentioned above), then the calculation is simpler. But if your salary falls in more than one range, the income tax is the sum of the tax calculated from each slab as per the designated tax rate of the said financial year.

In other words,

Income tax for income in Slab II = 10% of Slab I + 20% of slab II

Income tax for income in Slab III = 10% of Slab I + 20% of Slab II + 30% of Slab III

Here’s an example* of the income tax calculation of a person earning Rs.10 lakhs, and a comparison of how he will fare with this year’s budget rules as opposed to those of last year’s –

2 Comments

Sir can you provided all Punjab local government exam material to my email id

please mention section 87 a for rebate rs 2000 from tax